Hi, can I have your number? Equifax’s guide to finding a Valentine’s date

Sydney, Australia: Friday 13 February 2015 – Pick-up lines might make you cringe, but ‘Hi, can I have your number?’ is a conversation starter that could connect you with a financially stable future partner.

According to credit agency Veda, one little (or big) number in the form of a credit score will tell you a lot about a person’s reliability and trustworthiness when it comes to money.

This Valentine’s Day Veda is playing cupid to help love seekers look in all the right places to find their perfect financial match.

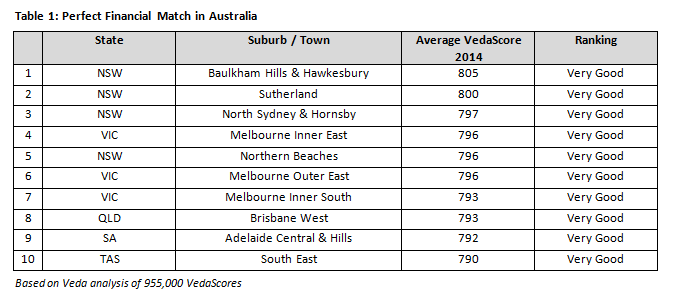

Analysis of Equifax Scores nationwide shows heading to the city fringes may pay off in more ways than one, with NSW regionsBaulkham Hills/Hawkesbury, Sutherland and North Sydney/Hornsby topping the chart as the three regions with the highest average Equifax Scores, indicating the best locations in Australia to land yourself a love interest with responsible financial behaviours.

Also in the top five locations is the trendy Inner East of Melbourne Victoria and the stunning Northern Beaches of Sydney in NSW.

Rounding out the top 10 locations in Australia are: suburbs in the Outer East and Inner South of Melbourne Victoria; the rural-residential areas of Brisbane West in Queensland; the picturesque Adelaide Central/Hills in South Australia; and rolling hills ofSouth East Tasmania.

Veda spokesperson Belinda Diprose said: “Singles searching for their perfect financial match have a wonderful selection of beautiful places to choose from. From the beautiful Northern Beaches of Sydney to the scenic Adelaide Hills, the backdrop is sure to thrill as much as their date’s number!”

An Equifax Score is a number between 0 and 1,200 that summarises information on your Veda credit report at a specific point in time.

“Financial stability isn’t just about how much money you have. Having careful financial practices is as important for long term financial freedom,” Ms Diprose said.

“Every time you apply for credit, a personal loan or pay a bill it contributes to your overall credit history and Equifax Score. This is used by lenders to judge your risk and reliability, so it’s a major player in whether you’ll be able to access credit in the future.

“‘What’s your number?’ takes a whole new meaning this Valentine’s Day – a potential partner’s level of financial stability is an important factor in compatibility,” she said.

On average Australians have a healthy credit profile; in 2014 the national average Equifax Score was 760 (classified in the Very Good category), up from 751 in 2013.

Being vigilant about paying bills, like phone bills and credit cards, could impact a person’s ability to access credit. Over time, positive credit behaviour will become essential to negotiate a better deal.

“It’s more important than ever for Australians to understand what’s on their credit report and what their credit score is in order to get a better deal. Lenders have started releasing products that offer the best interest rates to those with the best Equifax Scores,” Ms Diprose said.

Consumers can access and actively manage their credit record and Equifax Score, as well as the items on their credit report that contributed to their score being good or bad, through Veda’s consumer online portal at www.veda.com.au.

For more information about credit scores visit:

http://www.veda.com.au/yourcreditandidentity/check/Equifax Score

To view media release for specific regions around Australia click below:

Sydney metro

Brisbane

Ballarat

Cairns

Central West

Melbourne Metro

Mornington

New England

Sunshine Coast