Take control of your identity: ‘tis the season to protect yours

Sydney, Australia: 27 November 2014 – While Christmas is the season of shopping and socialising, Australians are warned that ‘oversharing’ or lax security about your personal and financial details can open the doors to opportunistic scammers.

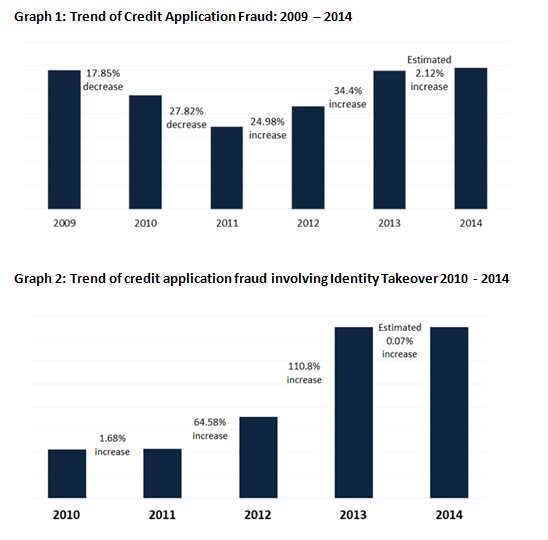

Veda fraud data released today shows that Australians have an ongoing risk of having their identity stolen, with fraudulent credit applications involving identity takeover increasing by 110% over the past two years[1].

The new report on credit application fraud, revealed that while total reported incidences of fraud bottomed out in 2011, they are now rising again and approaching 2009 peak levels (refer to Graph 1). Veda attributes this increase to rising credit activity, as well as better reporting of fraud data.

Fraud that occurs when applying for credit via online channels has increased steadily, accounting for just over half (51%) of all credit application fraud events in the last year.

Fiona Long, Veda’s Head of Cybercrime, said the report was a timely reminder as the sheer volume of financial transactions in-store and online at Christmas – when online shopping, increased communications and the holiday rush – can make people more vulnerable to identity theft.

“Christmas is a time when we share more information about ourselves online and our spending increases. This brings a greater risk that our personal and financial identity will be exposed. Something as simple as providing your name and date of birth can attract scammers,” she said.

“Our report revealed that drivers licences and personal information such as name and date of birth continue to be key pieces of information used in many identity takeover cases.”

Identity takeover accounts for 13% of all credit application fraud activity. Consumers should be aware that a simple credit file alert service can help protect you from falling victim to this type of identity takeover.

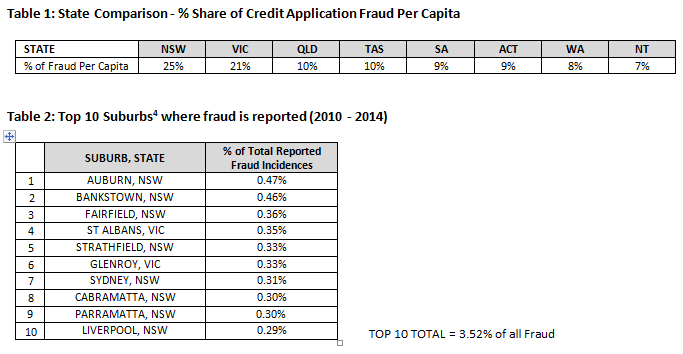

NSW and Victoria experience the highest fraud per capita, together attracting almost half of all fraud incidences in the last year: 25% in NSW and 21% in Victoria. According to Veda, addresses used on fraudulent credit applications tend to be higher in city suburbs as crime syndicates target areas with higher populations, due to application fraud being more easily detected in areas with lower volumes.

Veda’s report showed that in 2014 almost half (47%) of all credit application fraud involves applications for credit cards.

Ms Long said the data highlighted that shopping habits, both in-store and online, were critical to protecting your identity and Australians should put in place a few different but simple security techniques to protect themselves.

“How people interact online and on social media sites such as Facebook, Twitter and LinkedIn can also make a big difference to how vulnerable people are to having their identity stolen. Oversharing in online social forums, such as telling the world you’re going away on holiday, can escalate your exposure to risk. Even if you don’t publish your birthday on Facebook if your profile is public people can figure it out by looking for Happy Birthday posts from friends and family.”

Veda data shows that more than one in five Australians (23%) have experienced some form of identity crime[2], and 68% of people worry about putting their personal information online[3].

“It’s worth taking steps to protect your identity – it’s the most valuable asset you own. People can sign up for services that will alert them if personal information such as their email address or bank account details are being illegally traded online. Knowing when you are at risk because your information has been compromised means you can take action before you fall victim to financial crime,” Ms Long said.

“Be aware of your environment when using a debit or credit card, or an ATM. Online, carefully check suppliers and that their payment gates are secure, shown by ‘https’ in the URL. Read the fine print so you know what the supplier is going to do with your personal information and always keep a record of the transaction and any contact with the seller.

“It’s also critical, particularly over the holiday season, to protect your personal information at home. Lock your mailbox, keep documents with personal information hidden and shred personal and financial information before it goes in the bin. While it sounds like something that only happens in the movies, trawling through rubbish and stealing mail is one of the ways some local scammers gather your information so they can misuse it by selling it on the blackmarket or opening up accounts in your name.”

VEDA’S 5 TIPS TO A SAFE CHRISTMAS

1. Never provide your mother’s maiden name, bank password or date of birth when doing your Christmas shopping online.

2. Check your bank statements after you finish your Christmas shopping and investigate any suspicious activity like small payments to unknown companies or people.

3. Only tell a few trusted people when you go on holidays – don’t tell the world on Facebook.

4. Get the gift of identity protection by signing up for Veda’s Your Credit & Identity service to get credit file alerts and alert you if your personal information is being illegaly traded online.

5. If you are going away make sure your have a secure mailbox or someone is collecting mail for you.

Social Media Hashtag: #identitywatch

[1] Veda Identity Watch Research, Credit Application Fraud Statistics: 2009 - 2014, November 2014