Credit card demand contributes to positive index

Veda Quarterly Business Credit Demand Index: December 2014

Credit card demand contributes to positive index

Mortgage demand continues to ease

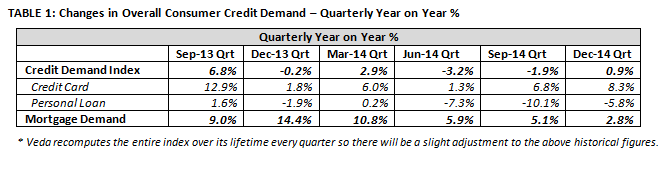

- Overall consumer credit demand grew 0.9% (vs December quarter 2013)

- Credit card applications up 8.3% vs December quarter 2013

- Personal loan applications down 5.8% vs December quarter 2013

- Growth in mortgage applications cools nationally to +2.8% (vs December quarter 2013).

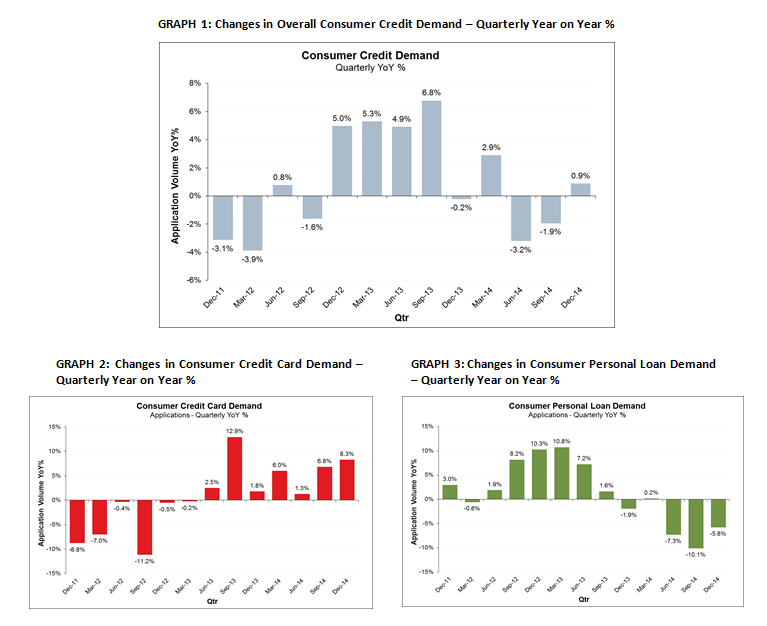

Sydney, Australia: 21 January 2015 – The Veda Quarterly Consumer Credit Demand Index, which measures the volume of credit card and personal loan applications processed through Veda’s Consumer Credit Bureau compared with the same period last year, remained flat with annual growth of 0.9% in the December quarter.

Demand for credit cards, up 8.3% for the quarter, was offset by a -5.8% contraction in demand for personal loans compared with the December quarter 2013.

Angus Luffman, Veda’s General Manager of Consumer Risk, said despite the continuing appetite for credit cards, overall credit demand has been relatively flat over the past five quarters.

“We have now seen seven consecutive quarters of growth for credit card applications, the longest period of sustained growth since the Index has been published," Mr Luffman said.

“At the same time we have seen five quarters of negative or negligible growth in personal loan applications.

“Demand for personal loans is strongly influenced by car sales. Over the 12 months to November 2014, car sales fell by 3.8%,” Mr Luffman said.

Released today, the Veda Quarterly Consumer Credit Demand Index provides an early indication of movements in consumer spending and retail sales.

Growth in credit card applications was up 8.3% in the December quarter, up from 6.8% in the September 2014 quarter. Applications grew in all states. Tasmania (+12.3%), NT (+10.7%), Queensland (+10.7%) and SA (+10.2%) all experienced double digit growth. Victoria (+7.5%), NSW (+7.4%), WA (+7.1%), and ACT (+3.7%) all saw growth.

Despite the sustained period of credit card demand, the credit aggregates for non-housing retail credit remain relatively stable.

Nationally, personal loan applications fell to -5.8% in the December quarter, following a -10.1% contraction during the September quarter. Applications declined across all states: NT showed the largest contraction (-12.4%) in applications, followed by WA (-11.2%), ACT (‑8.8%), NSW (-6.9%), Victoria (-4.6%), SA (-3.9%), Queensland (-3%) and Tasmania (-0.1%).

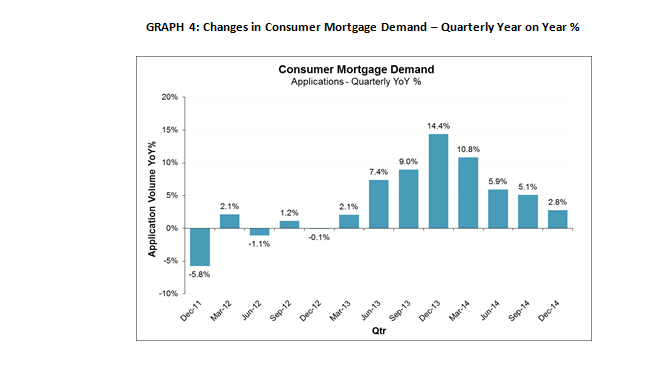

The rate of growth in mortgage applications eased for the fourth quarter in a row, growing nationally at 2.8% in the December quarter.

Mortgage applications are not part of the Consumer Credit Demand Index, but are a good lead indicator of future activity in home buyer demand and housing turnover. Historically, movements in Veda mortgage demand have tended to lead movements in house prices by around six to nine months.

All states are experiencing a slow down in the rate of growth or a contraction in demand for mortgages.

ACT (+6.6%) NSW (+6.5%), Tasmania (+5.2%), Victoria (+2.9%) and Queensland (+1.7%) continued to grow moderately. NT (-3.9%), WA (-3.0%) and SA (-2.3%) experienced a contraction in mortgage demand.

“Mortgage application growth has slowed for four consecutive quarters and is down sharply from the peak of demand we saw 12 months ago,” Mr Luffman said.

“A slowdown in growth, and as we see in NT, SA and WA, a contraction in demand, is a lead indicator on the housing market and suggests a moderation in housing turnover and price growth over the coming months.

“We have seen consecutive quarters of shrinking mortgage demand in WA and SA, and a continuing slow down in growth in mortgage demand on the eastern seaboard.

“While interest rates are low in historic terms, and fuel prices are at post GFC lows, consumers seem to be cautious about taking on new credit commitments,” Mr Luffman said.

NOTE TO EDITORS

The Veda Quarterly Consumer Credit Demand Index measures the volume of credit card and personal loan applications that go through the Veda Consumer Credit Bureau by financial services credit providers in Australia. Credit applications represent an intention by consumers to acquire credit and in turn spend; therefore the index is a lead indicator. This differs to other market measures published by the RBA which measure credit provided by financial institutions (i.e. balances outstanding).

DISCLAIMER

Purpose of Veda Indices releases: Veda Indices releases are intended as a contemporary contribution to data and commentary in relation to credit activity in the Australian economy. The information in this release does not constitute legal, accounting or other professional financial advice. The information may change and Veda does not guarantee its currency, accuracy or completeness, and you should rely on your own analysis and enquiries. Veda has relied on third party information in compiling the Indices and has not been able to independently verify the accuracy of that information. To the extent permitted by law, Veda specifically excludes all liability or responsibility for any loss or damage arising out of reliance on information in this release and the data in this report, including any consequential or indirect loss, loss of profit, loss of revenue or loss of business opportunity.